Real brokerage introduces readers to a dynamic realm within the financial industry, offering a comprehensive look into the world of trading and investments. As we delve into the intricacies of real brokerages, a fascinating narrative unfolds, showcasing the pivotal role they play in the market landscape.

From the fundamental definition of real brokerage to the transformative impact of technology, this exploration promises to captivate and enlighten, making it an essential read for those keen on understanding this domain.

Introduction to Real Brokerage

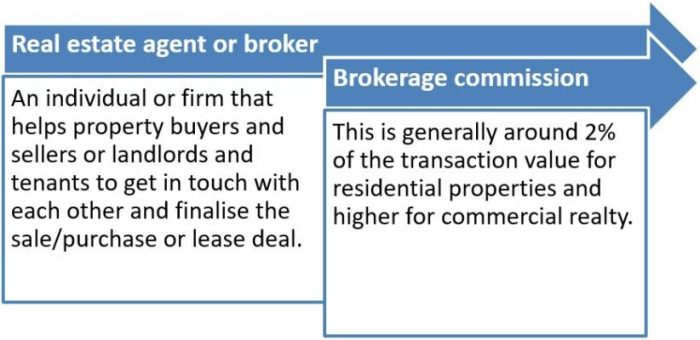

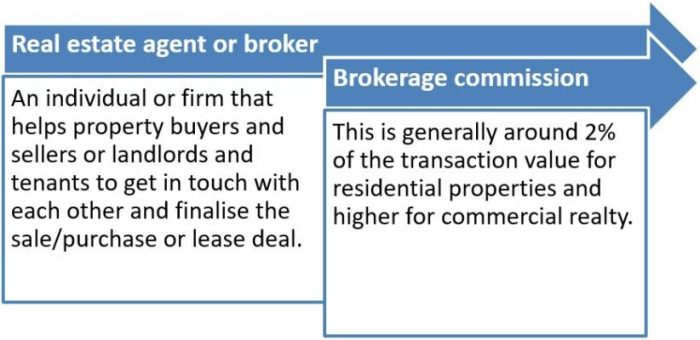

Real brokerage, in the context of the financial industry, refers to a firm or company that acts as an intermediary between buyers and sellers in financial markets. These firms facilitate the buying and selling of financial instruments such as stocks, bonds, commodities, and currencies.Real brokerage firms play a crucial role in the market by providing a platform for investors to execute trades efficiently and securely.

They offer a range of services including market research, trading platforms, investment advice, and portfolio management. Some well-known examples of real brokerage firms include Charles Schwab, E*TRADE, TD Ameritrade, and Interactive Brokers.

Significance of Real Brokerage Firms

Real brokerage firms serve as a bridge between investors and the financial markets, enabling individuals and institutions to participate in trading and investment activities. These firms provide access to a wide range of financial products and services, allowing investors to diversify their portfolios and manage risk effectively.

- Real brokerage firms offer trading platforms that allow investors to buy and sell securities quickly and efficiently.

- They provide research and analysis to help investors make informed decisions about their investments.

- Real brokerage firms offer a range of investment products such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- They provide guidance and support to investors, helping them navigate the complexities of the financial markets.

Services Offered by Real Brokerages

Real brokerages offer a range of services to assist clients in buying and selling financial assets. These services are designed to provide clients with the necessary tools and support to make informed decisions in the complex world of investing.

Investment Research and Analysis

Real brokerages provide clients with access to in-depth research and analysis on various financial assets, including stocks, bonds, and mutual funds. This information helps clients make well-informed investment decisions based on market trends, company performance, and economic indicators.

- Real-time market data and news updates

- Company financial reports and analysis

- Risk assessment and portfolio analysis

Trading Platforms and Tools

Brokerages offer clients access to trading platforms and tools that allow them to execute trades efficiently and effectively. These platforms provide real-time trading information, order placement capabilities, and portfolio tracking features.

- Online trading platforms

- Mobile trading apps

- Technical analysis tools

Financial Planning and Advisory Services

Real brokerages also offer financial planning and advisory services to help clients set and achieve their investment goals. This may include retirement planning, college savings plans, and estate planning.

- Personalized investment strategies

- Retirement planning services

- Estate planning and wealth management

Technology and Real Brokerage

Technology has significantly transformed the operations of real brokerages, enhancing efficiency and increasing accessibility for clients. The impact of online trading platforms and the integration of artificial intelligence and machine learning have revolutionized real estate brokerage services.

Impact of Online Trading Platforms

Online trading platforms have revolutionized the real estate industry by providing a convenient and efficient way for clients to buy, sell, or rent properties. These platforms enable users to search for properties, view listings, and even complete transactions online. The availability of virtual tours and 3D property viewing tools has made it easier for clients to explore properties remotely, saving time and resources for both clients and real estate agents.

Additionally, online platforms offer real-time updates on property listings and market trends, empowering clients to make informed decisions quickly.

Integration of Artificial Intelligence and Machine Learning

Real brokerages are increasingly incorporating artificial intelligence and machine learning technologies into their operations to streamline processes and improve customer experiences. These technologies can analyze large sets of data to predict market trends, assess property values, and identify potential leads.

AI-powered chatbots and virtual assistants can provide instant responses to client inquiries, enhancing communication and engagement. Machine learning algorithms can also personalize recommendations for clients based on their preferences and previous interactions, creating a more tailored and efficient service experience.

Regulatory Framework for Real Brokerages

Real brokerages are subject to specific regulatory requirements to ensure transparency, fairness, and investor protection within the industry.

Regulatory Requirements for Real Brokerages

Real brokerages must comply with various regulations set forth by government authorities and regulatory bodies. These requirements typically include:

- Maintaining proper licensing and registration to operate legally

- Adhering to strict codes of conduct and ethical standards

- Ensuring proper disclosure of information to clients

- Implementing risk management practices to protect investors

Role of Regulatory Bodies

Regulatory bodies play a crucial role in overseeing real brokerage activities to maintain market integrity and investor confidence. They are responsible for:

- Monitoring compliance with regulatory requirements

- Enforcing penalties for violations of regulations

- Conducting investigations into misconduct or fraud

- Providing guidance and education to industry professionals

Importance of Investor Protection Regulations

Investor protection regulations are essential in the real brokerage industry to safeguard the interests of investors and maintain trust in the financial markets. These regulations:

- Ensure fair treatment of investors by brokerage firms

- Protect investors from fraudulent activities or misrepresentation

- Enhance transparency and disclosure of information to clients

- Promote confidence in the financial system and investments

Different Types of Real Brokerages

When it comes to real estate brokerages, there are various types that cater to different needs and preferences of clients. Understanding the differences between full-service and discount real brokerages, as well as traditional versus online-only options, can help investors make informed decisions.

Full-Service vs. Discount Real Brokerages

Full-service real brokerages offer a wide range of services to clients, including property valuation, marketing, negotiations, and closing assistance. They typically charge higher commission rates but provide a more comprehensive experience for clients. On the other hand, discount real brokerages offer limited services at a lower cost, often focusing on specific aspects such as listing properties on the MLS.

While they may be more cost-effective, clients may need to take on more responsibilities throughout the transaction process.

Traditional vs. Online-Only Real Brokerages

Traditional real brokerages have physical offices where clients can meet with agents, view properties, and discuss their needs in person. These brokerages have a long-standing presence in the market and often have established networks and relationships. Online-only real brokerages, on the other hand, operate solely through digital platforms, offering convenience and efficiency.

Clients can access listings, communicate with agents, and complete transactions online. While online-only brokerages may lack the personal touch of traditional firms, they can provide cost savings and streamlined processes.

Pros and Cons of Different Types of Real Brokerages for Investment Purposes

- Full-Service Brokerages:Pros - Comprehensive services, experienced agents, personalized guidance. Cons - Higher commission rates, potential for higher costs.

- Discount Brokerages:Pros - Cost-effective, specific services available. Cons - Limited assistance, more client involvement required.

- Traditional Brokerages:Pros - Established reputation, in-person support, local market expertise. Cons - Potentially higher costs, less focus on technology.

- Online-Only Brokerages:Pros - Convenience, cost savings, efficient processes. Cons - Lack of personal interaction, potential limitations in service offerings.

Ending Remarks

In conclusion, the journey through the realm of real brokerage has shed light on the diverse services, regulatory frameworks, and types of brokerages that shape this industry. As we navigate the complexities and nuances of this field, one thing remains clear - real brokerages are instrumental in facilitating financial transactions and empowering investors worldwide.

Answers to Common Questions

What services can I expect from a real brokerage firm?

Real brokerage firms offer a range of services including trading assistance, investment advice, research reports, and asset management.

How do regulatory bodies oversee real brokerage activities?

Regulatory bodies monitor real brokerage activities to ensure compliance with laws and regulations, safeguarding investor interests and maintaining market integrity.

What are the differences between full-service and discount real brokerages?

Full-service brokerages provide a wide range of services and personalized advice, while discount brokerages offer lower fees but with fewer advisory services.

Real brokerage introduces readers to a dynamic realm within the financial industry, offering a comprehensive look into the world of trading and investments. As we delve into the intricacies of real brokerages, a fascinating narrative unfolds, showcasing the pivotal role they play in the market landscape.

From the fundamental definition of real brokerage to the transformative impact of technology, this exploration promises to captivate and enlighten, making it an essential read for those keen on understanding this domain.

Introduction to Real Brokerage

Real brokerage, in the context of the financial industry, refers to a firm or company that acts as an intermediary between buyers and sellers in financial markets. These firms facilitate the buying and selling of financial instruments such as stocks, bonds, commodities, and currencies.Real brokerage firms play a crucial role in the market by providing a platform for investors to execute trades efficiently and securely.

They offer a range of services including market research, trading platforms, investment advice, and portfolio management. Some well-known examples of real brokerage firms include Charles Schwab, E*TRADE, TD Ameritrade, and Interactive Brokers.

Significance of Real Brokerage Firms

Real brokerage firms serve as a bridge between investors and the financial markets, enabling individuals and institutions to participate in trading and investment activities. These firms provide access to a wide range of financial products and services, allowing investors to diversify their portfolios and manage risk effectively.

- Real brokerage firms offer trading platforms that allow investors to buy and sell securities quickly and efficiently.

- They provide research and analysis to help investors make informed decisions about their investments.

- Real brokerage firms offer a range of investment products such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- They provide guidance and support to investors, helping them navigate the complexities of the financial markets.

Services Offered by Real Brokerages

Real brokerages offer a range of services to assist clients in buying and selling financial assets. These services are designed to provide clients with the necessary tools and support to make informed decisions in the complex world of investing.

Investment Research and Analysis

Real brokerages provide clients with access to in-depth research and analysis on various financial assets, including stocks, bonds, and mutual funds. This information helps clients make well-informed investment decisions based on market trends, company performance, and economic indicators.

- Real-time market data and news updates

- Company financial reports and analysis

- Risk assessment and portfolio analysis

Trading Platforms and Tools

Brokerages offer clients access to trading platforms and tools that allow them to execute trades efficiently and effectively. These platforms provide real-time trading information, order placement capabilities, and portfolio tracking features.

- Online trading platforms

- Mobile trading apps

- Technical analysis tools

Financial Planning and Advisory Services

Real brokerages also offer financial planning and advisory services to help clients set and achieve their investment goals. This may include retirement planning, college savings plans, and estate planning.

- Personalized investment strategies

- Retirement planning services

- Estate planning and wealth management

Technology and Real Brokerage

Technology has significantly transformed the operations of real brokerages, enhancing efficiency and increasing accessibility for clients. The impact of online trading platforms and the integration of artificial intelligence and machine learning have revolutionized real estate brokerage services.

Impact of Online Trading Platforms

Online trading platforms have revolutionized the real estate industry by providing a convenient and efficient way for clients to buy, sell, or rent properties. These platforms enable users to search for properties, view listings, and even complete transactions online. The availability of virtual tours and 3D property viewing tools has made it easier for clients to explore properties remotely, saving time and resources for both clients and real estate agents.

Additionally, online platforms offer real-time updates on property listings and market trends, empowering clients to make informed decisions quickly.

Integration of Artificial Intelligence and Machine Learning

Real brokerages are increasingly incorporating artificial intelligence and machine learning technologies into their operations to streamline processes and improve customer experiences. These technologies can analyze large sets of data to predict market trends, assess property values, and identify potential leads.

AI-powered chatbots and virtual assistants can provide instant responses to client inquiries, enhancing communication and engagement. Machine learning algorithms can also personalize recommendations for clients based on their preferences and previous interactions, creating a more tailored and efficient service experience.

Regulatory Framework for Real Brokerages

Real brokerages are subject to specific regulatory requirements to ensure transparency, fairness, and investor protection within the industry.

Regulatory Requirements for Real Brokerages

Real brokerages must comply with various regulations set forth by government authorities and regulatory bodies. These requirements typically include:

- Maintaining proper licensing and registration to operate legally

- Adhering to strict codes of conduct and ethical standards

- Ensuring proper disclosure of information to clients

- Implementing risk management practices to protect investors

Role of Regulatory Bodies

Regulatory bodies play a crucial role in overseeing real brokerage activities to maintain market integrity and investor confidence. They are responsible for:

- Monitoring compliance with regulatory requirements

- Enforcing penalties for violations of regulations

- Conducting investigations into misconduct or fraud

- Providing guidance and education to industry professionals

Importance of Investor Protection Regulations

Investor protection regulations are essential in the real brokerage industry to safeguard the interests of investors and maintain trust in the financial markets. These regulations:

- Ensure fair treatment of investors by brokerage firms

- Protect investors from fraudulent activities or misrepresentation

- Enhance transparency and disclosure of information to clients

- Promote confidence in the financial system and investments

Different Types of Real Brokerages

When it comes to real estate brokerages, there are various types that cater to different needs and preferences of clients. Understanding the differences between full-service and discount real brokerages, as well as traditional versus online-only options, can help investors make informed decisions.

Full-Service vs. Discount Real Brokerages

Full-service real brokerages offer a wide range of services to clients, including property valuation, marketing, negotiations, and closing assistance. They typically charge higher commission rates but provide a more comprehensive experience for clients. On the other hand, discount real brokerages offer limited services at a lower cost, often focusing on specific aspects such as listing properties on the MLS.

While they may be more cost-effective, clients may need to take on more responsibilities throughout the transaction process.

Traditional vs. Online-Only Real Brokerages

Traditional real brokerages have physical offices where clients can meet with agents, view properties, and discuss their needs in person. These brokerages have a long-standing presence in the market and often have established networks and relationships. Online-only real brokerages, on the other hand, operate solely through digital platforms, offering convenience and efficiency.

Clients can access listings, communicate with agents, and complete transactions online. While online-only brokerages may lack the personal touch of traditional firms, they can provide cost savings and streamlined processes.

Pros and Cons of Different Types of Real Brokerages for Investment Purposes

- Full-Service Brokerages:Pros - Comprehensive services, experienced agents, personalized guidance. Cons - Higher commission rates, potential for higher costs.

- Discount Brokerages:Pros - Cost-effective, specific services available. Cons - Limited assistance, more client involvement required.

- Traditional Brokerages:Pros - Established reputation, in-person support, local market expertise. Cons - Potentially higher costs, less focus on technology.

- Online-Only Brokerages:Pros - Convenience, cost savings, efficient processes. Cons - Lack of personal interaction, potential limitations in service offerings.

Ending Remarks

In conclusion, the journey through the realm of real brokerage has shed light on the diverse services, regulatory frameworks, and types of brokerages that shape this industry. As we navigate the complexities and nuances of this field, one thing remains clear - real brokerages are instrumental in facilitating financial transactions and empowering investors worldwide.

Answers to Common Questions

What services can I expect from a real brokerage firm?

Real brokerage firms offer a range of services including trading assistance, investment advice, research reports, and asset management.

How do regulatory bodies oversee real brokerage activities?

Regulatory bodies monitor real brokerage activities to ensure compliance with laws and regulations, safeguarding investor interests and maintaining market integrity.

What are the differences between full-service and discount real brokerages?

Full-service brokerages provide a wide range of services and personalized advice, while discount brokerages offer lower fees but with fewer advisory services.