Building a Personal Emergency Fund: Global Advice sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Exploring the importance of financial preparedness and the global perspectives surrounding emergency fund building, this topic delves into crucial aspects of personal finance that resonate universally.

Importance of Building a Personal Emergency Fund

Building a personal emergency fund is crucial for financial stability and peace of mind. It acts as a safety net during unexpected situations, providing a buffer against financial hardship and reducing stress and anxiety.

Financial Security

Having an emergency fund ensures that you are prepared for unforeseen expenses such as medical emergencies, car repairs, or sudden job loss. It helps you avoid going into debt or having to dip into long-term savings to cover these unexpected costs.

Peace of Mind

Knowing that you have a financial cushion in place can alleviate the stress and anxiety that often come with unexpected financial challenges. Instead of worrying about how you will manage in a crisis, you can focus on finding solutions and navigating the situation effectively.

Independence and Flexibility

An emergency fund gives you the independence to handle financial emergencies without relying on external sources of funding. It provides the flexibility to make decisions based on what is best for your financial well-being, rather than being forced into choices due to a lack of funds.

Opportunity for Growth

By building a personal emergency fund, you create a foundation for financial growth and stability. It allows you to weather financial setbacks without derailing your long-term financial goals, enabling you to continue building wealth and financial security over time.

Determining the Right Amount for Your Emergency Fund

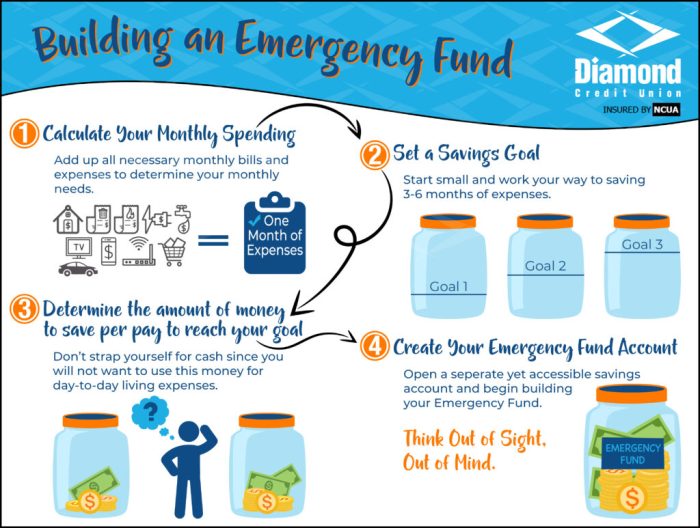

When it comes to building an emergency fund, one of the crucial steps is determining the right amount to set aside for unexpected expenses. This amount can vary depending on individual circumstances and financial goals.

Guidelines for Calculating Your Emergency Fund

- Financial experts often recommend saving three to six months' worth of living expenses as a baseline for your emergency fund. This can provide a buffer in case of job loss, medical emergencies, or other unforeseen events.

- Consider your monthly expenses, including rent or mortgage, utilities, groceries, insurance, and other essential costs. Multiply this by the number of months you aim to cover to determine your target amount.

- Take into account any additional factors that may affect your financial stability, such as dependents, health issues, or industry volatility.

Factors to Consider for Setting the Fund Size

- Your income level plays a significant role in determining the size of your emergency fund. Higher incomes may require larger reserves to maintain the same standard of living during a financial crisis.

- Your job security and industry stability can influence the recommended amount for your emergency fund. Those in more volatile industries may need to save more to prepare for potential layoffs.

- Your risk tolerance and comfort level with financial uncertainty should also be taken into consideration. Some individuals may prefer a larger emergency fund for added peace of mind.

Examples of Approaches Based on Income and Expenses

- Percentage-Based Approach:Some financial advisors suggest saving a set percentage of your income, such as 10% to 20%, towards your emergency fund. This method can help ensure consistent savings regardless of income fluctuations.

- Expense-Based Approach:Calculating your emergency fund based on a multiple of your monthly expenses, such as three to six times your essential costs, can provide a more tailored savings goal.

- Hybrid Approach:Combining both income percentage and expense multiples can offer a balanced strategy for building an emergency fund that aligns with your financial situation.

Strategies for Building an Emergency Fund

Building an emergency fund is crucial for financial stability. Here are some effective strategies to help you start building and growing your emergency fund:

1. Automatic Transfers

Setting up automatic transfers from your checking account to a separate savings account can help you consistently save a portion of your income without having to think about it. This ensures that you prioritize saving for emergencies before spending on non-essential items.

2. Budget Cuts

Review your monthly expenses and identify areas where you can cut back. By reducing unnecessary spending on items like dining out, subscription services, or shopping, you can redirect those funds towards your emergency fund. Consider creating a detailed budget to track your expenses and identify saving opportunities.

3. Additional Income Sources

Explore opportunities to increase your income, such as taking on a side hustle, freelancing, or selling unused items. The extra income generated can be directly allocated to your emergency fund, accelerating the growth of your savings.

4. Stay Motivated and Consistent

To stay motivated in building your emergency fund, set specific savings goals and track your progress regularly. Celebrate small milestones along the way to keep yourself motivated. Consider visualizing your financial goals by creating a vision board or using a savings tracker to monitor your emergency fund growth.By implementing these strategies and staying committed to your savings plan, you can build a robust emergency fund to protect yourself from unexpected financial hardships.

Global Perspectives on Emergency Fund Building

In different countries around the world, attitudes towards emergency savings can vary greatly. Cultural norms, economic conditions, and government policies all play a role in shaping how individuals approach building an emergency fund.

Cultural Differences in Attitudes Towards Emergency Savings

- In some countries, such as Japan, saving money is deeply ingrained in the culture. The concept of "mottainai," which means a sense of regret for wasting resources, encourages people to save for the future.

- On the other hand, in countries like the United States, there is a strong emphasis on consumerism and spending, which can make it challenging for individuals to prioritize saving for emergencies.

- In Scandinavian countries like Norway and Sweden, robust social welfare systems provide a safety net that may reduce the perceived need for large personal emergency funds.

Influence of Economic Factors and Government Policies

- Economic factors such as inflation, unemployment rates, and income inequality can impact individuals' ability to save for emergencies. High inflation rates may erode the value of savings over time, making it harder for individuals to build a sufficient emergency fund.

- Government policies, such as tax incentives for saving or regulations on financial institutions, can also influence emergency fund practices. For example, some countries offer tax breaks for contributions to specific savings accounts designated for emergencies.

Successful Emergency Fund Initiatives Around the World

- In Singapore, the Central Provident Fund (CPF) is a mandatory savings scheme that includes a portion dedicated to healthcare and retirement, serving as a form of emergency fund for citizens.

- In the United Kingdom, the Money Advice Service provides resources and tools to help individuals budget and save for emergencies, promoting financial literacy and preparedness.

- In India, the Pradhan Mantri Jan Dhan Yojana (PMJDY) program aims to provide financial inclusion to all households, encouraging savings and building a financial safety net for emergencies.

Concluding Remarks

In conclusion, Building a Personal Emergency Fund: Global Advice serves as a beacon of financial wisdom, guiding individuals towards a secure future and highlighting the significance of proactive financial planning.

Detailed FAQs

What is the significance of having a personal emergency fund?

Having a personal emergency fund provides a financial safety net during unexpected situations, reducing stress and anxiety.

How to calculate the ideal amount for an emergency fund?

Guidelines for calculating the ideal amount include considering factors such as income, expenses, and financial goals.

What are some strategies for building an emergency fund?

Strategies include specific steps to start saving, different saving techniques like automatic transfers or budget cuts, and tips to stay motivated in contributing regularly.

How do cultural differences influence attitudes towards emergency savings globally?

Cultural differences impact attitudes towards emergency savings, reflecting varying perspectives on financial preparedness across different countries.

Are there successful emergency fund initiatives globally?

Yes, various countries have implemented successful emergency fund programs, demonstrating the effectiveness of proactive financial planning on a global scale.