Embark on a journey exploring the advantages and factors to consider when incorporating AI in financial planning. This intricate blend of technology and finance promises a deeper understanding of how AI revolutionizes the financial landscape.

Delve into the specifics of how AI streamlines financial forecasting accuracy and enhances customer experiences within the realm of financial services.

Benefits of AI in Financial Planning

AI technology has revolutionized the field of financial planning, offering a wide range of benefits that enhance accuracy, efficiency, and customer experience.

Improved Accuracy in Financial Forecasting

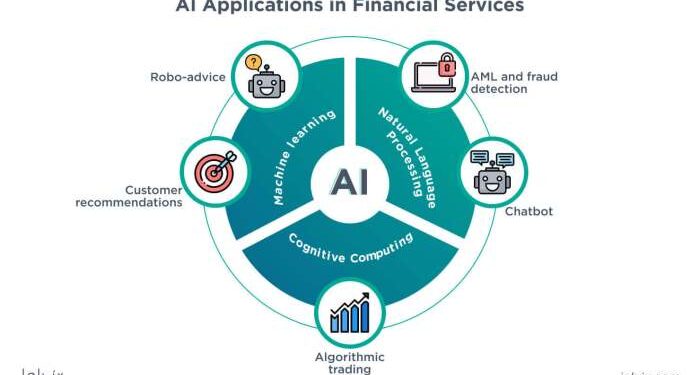

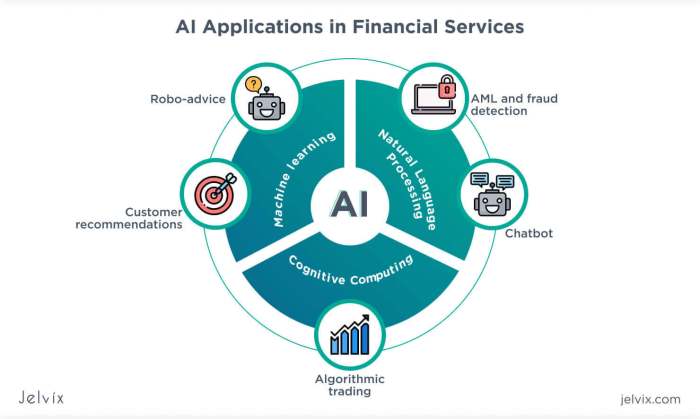

AI algorithms have the ability to analyze vast amounts of financial data quickly and accurately, resulting in more precise forecasts for businesses and individuals. By utilizing machine learning and data analytics, AI can identify patterns and trends that may not be evident to human analysts, leading to more reliable predictions for future financial outcomes.

Detection of Anomalies and Fraud in Financial Transactions

One of the key advantages of AI in financial planning is its ability to detect anomalies and potential fraudulent activities in real-time. AI-powered systems can monitor transactions and flag any suspicious behavior, helping financial institutions prevent fraud and protect their clients' assets.

This proactive approach to security is crucial in today's digital age where cyber threats are constantly evolving.

Optimizing Investment Strategies

AI plays a crucial role in optimizing investment strategies by analyzing market trends, risk factors, and individual preferences to recommend personalized investment options. Through algorithms that can process vast amounts of data and provide insights in real-time, AI helps investors make informed decisions that align with their financial goals and risk tolerance levels.

Enhanced Customer Experience in Financial Services

AI-powered chatbots and virtual assistants have transformed the way customers interact with financial institutions, offering personalized recommendations, 24/7 support, and streamlined processes. By leveraging AI technology, financial companies can deliver a seamless and efficient customer experience that meets the evolving demands of today's tech-savvy consumers.

Considerations for Implementing AI in Financial Planning

Implementing AI in financial planning comes with various considerations that organizations need to address to ensure successful integration and usage. From challenges in integrating AI solutions to ethical considerations, it is essential to navigate these factors effectively.

Key Challenges in Integrating AI Solutions

When incorporating AI into existing financial systems, organizations may face challenges such as compatibility issues, data integration complexities, and resistance from employees accustomed to traditional methods. Ensuring a smooth transition and overcoming these obstacles is crucial for the successful implementation of AI in financial planning.

Importance of Data Security and Privacy

Data security and privacy are paramount when utilizing AI in financial planning. Organizations must adhere to strict regulations and implement robust security measures to protect sensitive financial information. Maintaining the confidentiality and integrity of data is essential to build trust with clients and stakeholders.

Need for Transparency and Explainability in AI Algorithms

Transparency and explainability are essential aspects of AI algorithms used in financial decision-making. Organizations must be able to understand and interpret the outcomes generated by AI models to ensure accuracy and reliability. Providing transparency in the decision-making process helps build credibility and trust with clients.

Ethical Considerations in AI Implementation

The use of AI in financial planning raises ethical concerns related to bias, fairness, and accountability. Organizations must ensure that AI algorithms are free from biases and make decisions based on objective criteria. Ethical considerations play a crucial role in shaping the responsible use of AI in financial planning practices.

Ultimate Conclusion

Concluding our discussion on AI in Financial Planning: Benefits and Considerations, it becomes evident that the fusion of artificial intelligence and financial strategies opens doors to unprecedented possibilities. The ethical considerations and challenges highlighted serve as a reminder of the importance of a balanced approach in leveraging AI for financial planning.

FAQ Resource

How does AI enhance accuracy in financial forecasting?

AI streamlines data analysis processes, enabling more precise predictions and insights for future financial trends.

What are the key challenges in integrating AI solutions into existing financial systems?

Integrating AI may require significant system upgrades and training for existing staff to adapt to new technologies seamlessly.

Why is transparency crucial in AI algorithms for financial decision-making?

Transparency ensures that the decisions made by AI are understandable and traceable, instilling trust in the system.

What ethical considerations are associated with using AI in financial planning?

Ethical concerns may arise regarding data privacy, potential biases in algorithms, and the impact on employment in the financial sector.